The Impact of Property Taxes on Chicagoland Homeowners

Property taxes are a critical aspect of homeownership, and nowhere is this more evident than in Chicagoland. With its unique blend of urban and suburban communities, Cook County and its surrounding areas offer diverse housing opportunities—but property tax policies can significantly impact the affordability and long-term financial outlook for homeowners. As someone who was born and raised in Chicago and its suburbs, and who has navigated the real estate market for nearly two decades, I’ve seen firsthand how property taxes shape housing decisions and the local real estate landscape.

Understanding Property Taxes in Chicagoland

Property taxes in Cook County and the surrounding areas are calculated based on the assessed value of a property and the applicable tax rate for the municipality or district. These funds are essential for supporting local services such as schools, parks, and public safety, but they can vary widely depending on where you live. For example:

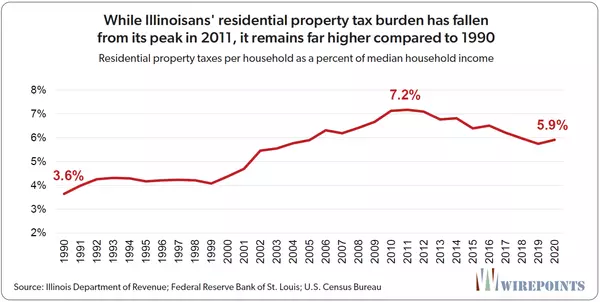

- Cook County: Known for its relatively high property taxes, Cook County’s rates can be a deterrent for some buyers, particularly in areas with rapidly appreciating home values.

- DuPage and Lake Counties: While offering more suburban amenities, these counties also have tax rates that can rival or exceed Cook County’s in certain municipalities.

- Will and Kane Counties: Often considered more affordable options, these counties tend to attract buyers seeking lower taxes and newer developments.

How Property Taxes Impact Homeownership

-

Affordability: For many first-time buyers, property taxes can be a make-or-break factor in determining which neighborhoods or suburbs they can afford. A seemingly affordable home may come with a hefty annual tax bill, increasing monthly costs significantly.

-

Resale Value: High property taxes can influence the resale value of a home, especially if buyers perceive the taxes as disproportionate to the services or amenities provided.

-

Equity Concerns: Tax assessments do not always keep pace with market conditions. Homeowners in rapidly appreciating neighborhoods may face steep increases in their tax bills, even if their income or ability to pay has not changed.

-

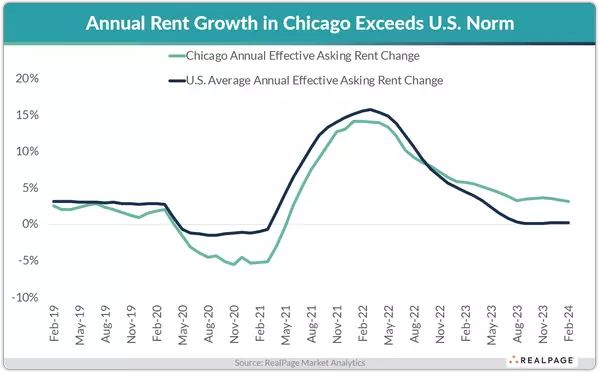

Market Trends: Property taxes can shift buyer demand across Chicagoland. For example, rising taxes in the city may push buyers to suburban areas, while tax incentives or abatements can make specific neighborhoods more attractive.

My Personal Observations

Having lived in many neighborhoods across Chicago as an adult and temporarily moved away, I’ve witnessed the nuances of property taxes in different areas. For instance, neighborhoods experiencing revitalization often see sharp increases in assessments, which can put pressure on long-time residents. In the suburbs, families may prioritize school districts, accepting higher taxes in exchange for quality education and community resources.

As a Realtor for nearly two decades, I’ve guided clients through countless decisions influenced by property taxes. I’ve worked with buyers surprised by their first tax bill and sellers seeking strategies to market homes in high-tax areas. These experiences have underscored the importance of understanding how taxes interact with home values and community priorities.

Navigating the Challenges of Property Taxes

-

Research Before You Buy: Whether you’re moving to a new suburb or considering a different neighborhood in Chicago, researching property tax rates is essential. Many municipalities publish tax information online, or you can consult with a local expert.

-

Appeal Your Assessment: If you believe your property has been over-assessed, you have the right to appeal. This process can save you money, but it requires evidence and careful navigation of county procedures.

-

Explore Tax Incentives: Some areas offer tax abatements or exemptions for certain groups, such as seniors, veterans, or first-time buyers. These programs can make homeownership more affordable.

-

Plan for the Long Term: If you’re planning to stay in a home for many years, consider how property taxes might change over time. Development, school funding needs, or municipal budget changes can all influence future rates.

Final Thoughts

Property taxes are an unavoidable part of homeownership, but understanding their impact can empower buyers and sellers to make informed decisions. Chicagoland’s diverse landscape means there’s no one-size-fits-all approach, but with careful planning and a solid grasp of local tax policies, it’s possible to navigate these challenges effectively.

As someone deeply connected to this region—both personally and professionally—I’ve seen how property taxes shape our communities and influence housing choices. By staying informed and proactive, homeowners can make the most of their investment while contributing to the vitality of the neighborhoods and suburbs they call home.

Vic Melecio - LPT Realty

Categories

Recent Posts