Buying Your First Multi-Family Property in Chicago: Guide

Purchasing your first multi-family property in Chicago can be an exciting and rewarding venture. With the city's diverse neighborhoods and vibrant real estate market, investing in a multi-family property offers the potential for significant financial returns and the opportunity to build long-term wealth. However, navigating the complexities of the Chicago real estate market requires careful planning and informed decision-making. This guide will provide you with essential insights and strategies to help you successfully buy your first multi-family property in Chicago, ensuring you make a sound investment that aligns with your financial goals.

Understanding the Chicago Real Estate Market

The Chicago real estate market is a dynamic and multifaceted landscape, characterized by its unique blend of historic charm and modern development. As one of the largest cities in the United States, Chicago offers a diverse range of neighborhoods, each with its own distinct personality and investment potential. Understanding the nuances of the Chicago real estate market is crucial for first-time buyers looking to invest in multi-family properties.

Chicago's real estate market is known for its cyclical nature, with periods of growth and contraction. Currently, the market is experiencing a steady rise in property values, making it an attractive option for investors. However, it's essential to conduct thorough research and stay informed about market trends to make informed decisions. Pay attention to factors such as neighborhood development plans, infrastructure improvements, and economic indicators that can impact property values.

Location is a critical factor when investing in multi-family properties in Chicago. Each neighborhood offers different opportunities and challenges, so it's important to choose an area that aligns with your investment goals. Popular neighborhoods for multi-family investments include Logan Square, Pilsen, and Bronzeville, each offering a unique mix of cultural attractions, amenities, and potential for rental income. Consider factors such as proximity to public transportation, schools, and employment centers when evaluating potential neighborhoods.

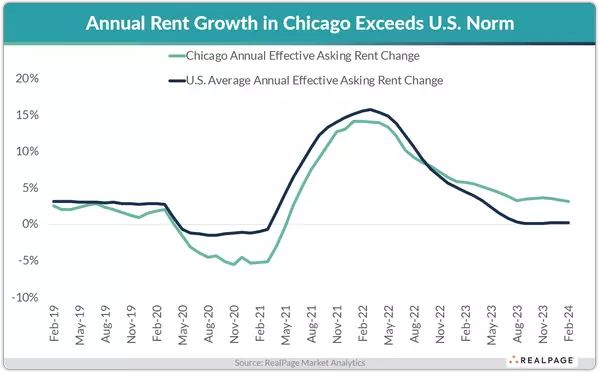

In addition to location, understanding the local rental market is crucial for successful multi-family property investment. Analyze rental demand, vacancy rates, and average rental prices in your target neighborhood to determine the potential for rental income. Chicago's rental market is competitive, with a high demand for quality rental units, particularly in desirable neighborhoods. By understanding the rental market dynamics, you can set competitive rental rates and attract reliable tenants, ensuring a steady cash flow from your investment.

Key Considerations for First-Time Buyers

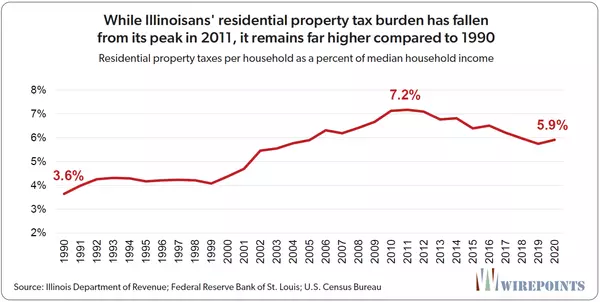

For first-time buyers, purchasing a multi-family property in Chicago requires careful consideration of various factors to ensure a successful investment. One of the primary considerations is determining your budget and financial capacity. Assess your current financial situation, including your savings, credit score, and debt-to-income ratio, to determine how much you can afford to invest. It's important to set a realistic budget that accounts for not only the purchase price but also additional costs such as property taxes, insurance, and maintenance expenses.

Another key consideration is conducting a thorough property inspection before making a purchase. Multi-family properties often come with unique challenges, such as shared walls, common areas, and potential maintenance issues. Hiring a qualified home inspector can help identify any structural or mechanical issues that may require immediate attention or future repairs. Understanding the condition of the property will enable you to negotiate a fair purchase price and plan for any necessary renovations or upgrades.

Understanding the legal and regulatory requirements associated with owning a multi-family property in Chicago is also crucial. Familiarize yourself with local zoning laws, building codes, and landlord-tenant regulations to ensure compliance and avoid potential legal issues. It's advisable to consult with a real estate attorney who specializes in multi-family properties to guide you through the legal aspects of the transaction and provide valuable insights into your rights and responsibilities as a property owner.

Lastly, consider the potential for future appreciation and value-add opportunities when purchasing a multi-family property. Look for properties that have the potential for renovation or improvement, as these can significantly increase the property's value and rental income. Additionally, consider the long-term growth prospects of the neighborhood and the potential for increased demand for rental units. By identifying properties with value-add potential, you can maximize your investment returns and build equity over time.

Financing Options for Multi-Family Properties

Financing a multi-family property in Chicago can be a complex process, but understanding the available options can help you secure the necessary funding for your investment. One of the most common financing options for multi-family properties is a conventional mortgage. Conventional loans are typically offered by banks and mortgage lenders and require a down payment of at least 20%. These loans offer competitive interest rates and flexible terms, making them a popular choice for many investors.

For first-time buyers with limited funds for a down payment, FHA loans may be a viable option. The Federal Housing Administration (FHA) offers loans specifically designed for multi-family properties with as little as 3.5% down payment. FHA loans are particularly beneficial for first-time buyers, as they have more lenient credit requirements and allow for higher debt-to-income ratios. However, it's important to note that FHA loans come with additional mortgage insurance premiums, which can increase the overall cost of the loan.

Another financing option to consider is a portfolio loan. Portfolio loans are offered by local banks and credit unions and are kept on the lender's balance sheet rather than being sold on the secondary market. These loans often have more flexible underwriting criteria and can be tailored to meet the specific needs of the borrower. Portfolio loans are an excellent option for investors with unique financial situations or those looking to finance larger multi-family properties.

For investors with significant equity in other properties, a home equity line of credit (HELOC) can be a valuable financing tool. A HELOC allows you to borrow against the equity in your existing property to fund the purchase of a new multi-family property. This option provides flexibility and can be a cost-effective way to access funds for your investment. However, it's important to carefully consider the risks associated with leveraging your existing property and ensure you have a solid repayment plan in place.

In conclusion, buying your first multi-family property in Chicago is a significant financial decision that requires careful planning and research. By understanding the Chicago real estate market, considering key factors for first-time buyers, and exploring various financing options, you can make an informed investment that aligns with your financial goals. With its diverse neighborhoods and strong rental demand, Chicago offers ample opportunities for investors to build wealth through multi-family property ownership. By following this guide and seeking professional advice when needed, you can navigate the complexities of the market and achieve success in your multi-family property investment journey.

Categories

Recent Posts