The Impact of Interest Rate Fluctuations on Chicago's Housing Market

Interest rate fluctuations have always played a pivotal role in shaping real estate markets, and Chicago is no exception. As one of the nation’s largest housing markets, Chicago experiences significant ripple effects when interest rates rise or fall. These changes influence buyer behavior, seller strategies, and overall market activity. Understanding these dynamics is essential for navigating the ever-changing landscape of Chicago’s real estate market.

How Interest Rates Affect Buyers

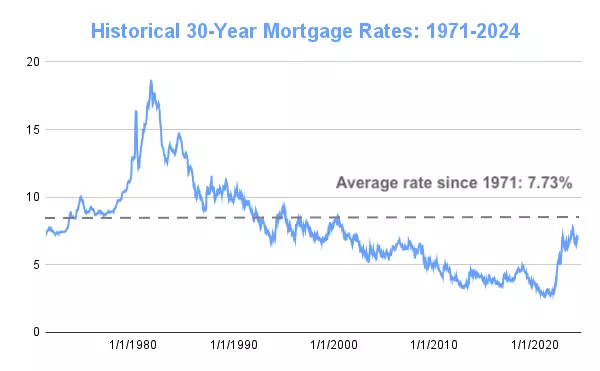

For homebuyers, interest rates directly impact affordability. Even a slight increase in mortgage rates can lead to higher monthly payments, which may push some potential buyers out of the market or force them to adjust their budgets.

Rising Interest Rates:

-

Decreased Purchasing Power: Higher rates mean buyers can afford less home for the same monthly budget. For example, a 1% increase in rates can reduce purchasing power by approximately 10%.

-

Hesitation to Enter the Market: Rising rates can deter first-time buyers, who may choose to delay their purchases in hopes of a market correction.

-

Shift to Adjustable-Rate Mortgages (ARMs): To offset higher fixed rates, some buyers may opt for ARMs, which offer lower initial rates but carry future risk.

Falling Interest Rates:

-

Increased Buyer Activity: Lower rates attract more buyers, making homeownership more accessible and driving up demand.

-

Refinancing Opportunities: Existing homeowners may refinance to secure better rates, increasing their purchasing power for future investments.

How Interest Rates Affect Sellers

Sellers, too, feel the impact of interest rate fluctuations, albeit indirectly. Their ability to sell quickly and at a favorable price often hinges on buyer activity and affordability.

Rising Interest Rates:

-

Longer Time on Market: Higher rates can cool buyer interest, leading to longer listing periods.

-

Pressure to Lower Prices: Sellers may need to reduce asking prices to align with buyers’ reduced budgets.

-

Fewer Move-Up Buyers: Homeowners with low-interest mortgages may hesitate to sell and buy a new home at a higher rate, reducing market activity.

Falling Interest Rates:

-

Competitive Pricing: Lower rates increase demand, often allowing sellers to maintain or raise prices.

-

Faster Transactions: Higher buyer activity leads to quicker sales and, in some cases, bidding wars.

-

More Move-Up Buyers: With favorable financing options, sellers are more likely to upgrade, contributing to overall market fluidity.

The Broader Impact on Chicago’s Market

Chicago’s real estate market is uniquely affected by interest rate fluctuations due to its diversity. The impact varies across different segments, from luxury high-rises in the Loop to single-family homes in suburbs like Naperville or Evanston.

-

Luxury Market: High-end properties often see less volatility, as affluent buyers are less sensitive to interest rate changes.

-

Suburban Market: Family-oriented buyers in the suburbs may feel the pinch of rising rates more acutely, as affordability becomes a critical factor.

-

Investment Properties: Higher rates can deter real estate investors who rely on favorable financing to achieve desired returns.

Strategies for Buyers and Sellers to Adapt

For Buyers:

-

Get Pre-Approved: Lock in current rates before they rise further, providing a clear budget for your home search.

-

Consider ARMs Carefully: While they can offer lower initial rates, understand the risks involved and have a long-term plan.

-

Prioritize Must-Haves: Be realistic about what you can afford and focus on properties that meet your core needs.

For Sellers:

-

Be Realistic with Pricing: Work with a real estate professional to set a price that aligns with current market conditions.

-

Enhance Property Appeal: Invest in staging or minor upgrades to stand out in a competitive market.

-

Be Flexible: Consider offering incentives, such as covering closing costs or buying down points, to attract rate-sensitive buyers.

Navigating the Future

As interest rates continue to fluctuate, staying informed is crucial for both buyers and sellers. Economic indicators, Federal Reserve policies, and market trends all play a role in shaping the housing market’s trajectory. Working with knowledgeable real estate professionals can help clients navigate these changes and make informed decisions.

While interest rates are beyond anyone’s control, understanding their impact and adapting strategies accordingly ensures that buyers and sellers can thrive in Chicago’s dynamic housing market.

Vic Melecio - LPT Realty

Categories

Recent Posts